Statewide and special election ballot questions explained

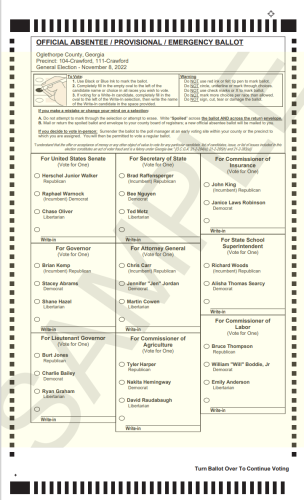

Practically everyone headed to the polls knows about the high-profile races on the ballot, such as the gubernatorial race between Gov. Brian Kemp and Stacey Abrams, and the U.S. Senate race between Raphael Warnock and Herschel Walker.

But, at the end of the ballot there are five less-talked about questions requiring a vote of “Yes” or “No.”

The first four questions fall into two categories: state constitutional amendments and referendums. The final question is a special election question for Oglethorpe County regarding T-SPLOST.

Here’s what each of those questions is asking and what a vote “Yes” means.

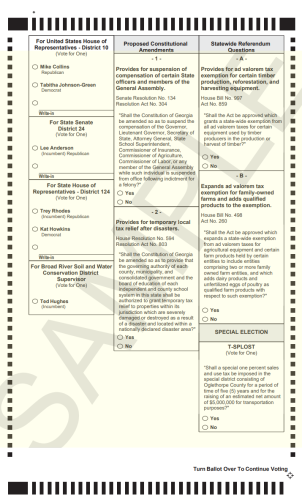

Proposed Amendment 1

- On the ballot: Provides for suspension of compensation of certain state officers and members of the General Assembly.

- "Shall the Constitution of Georgia be amended so as to suspend the compensation of the Governor, Lieutenant Governor, Secretary of State, Attorney General, State School Superintendent, Commissioner of Insurance, Commissioner of Agriculture, Commissioner of Labor, or any member of the General Assembly while such individual is suspended from office following indictment for a felony?"

- What it’s asking: If a Georgia state official is indicted for a felony and suspended from their job, should their compensation also be suspended?

- A vote “Yes” means: You support a change to the state constitution that would allow for a state official’s pay to be suspended if they are suspended from their job due to indictment for a felony. State officials who are not convicted and return to their roles would be entitled to back pay, according to Senate Resolution 134.

Proposed Amendment 2

- On the ballot: Provides for temporary local tax relief after disasters.

- "Shall the Constitution of Georgia be amended so as to provide that the governing authority of each county, municipality, and consolidated government and the board of education of each independent and county school system in this state shall be authorized to grant temporary tax relief to properties within its jurisdiction which are severely damaged or destroyed as a result of a disaster and located within a nationally declared disaster area?"

- What it’s asking: Should local governments be allowed to offer tax relief after natural disasters?

- A vote “Yes” means: You believe local governments should have the authority to grant temporary tax relief to properties that are severely damaged or destroyed after a natural disaster, according to House Resolution 594.

Referendum Question A

- On the ballot: Provides for ad valorem tax exemption for certain timber production, reforestation and harvesting equipment.

- "Shall the Act be approved which grants a state-wide exemption from all ad valorem taxes for certain equipment used by timber producers in the production or harvest of timber?"

- What it’s asking: Should there be statewide tax exemptions on equipment used for timber production and harvest?

- A vote “Yes” means: You believe there should be tax exemptions for certain equipment used in the timber industry. The tax-exempt equipment would include offroad machinery like skidders and chippers, but not motor vehicles, according to House Bill 997. The bill was passed and signed by the governor in May. It needs voter approval to go into law.

Referendum Question B

- On the ballot: Expands ad valorem tax exemption for family-owned farms and adds qualified products to the exemption.

- “Shall the Act be approved which expands a state-wide exemption from ad valorem taxes for agricultural equipment and certain farm products held by certain entities to include entities comprising two or more family owned farm entities, and which adds dairy products and unfertilized eggs of poultry as qualified farm products with respect to such exemption?”

- What it’s asking: Should the state provide tax exemptions on agricultural equipment owned by mergers of two or more family farms? Additionally, should eggs and dairy products be added to the list of farm products which are tax exempt?

- A vote “Yes” means: You support legislation that would expand tax exemptions for family farms. House Bill 498 was passed and signed by the governor last year, but still needs voter approval. The Georgia Farm Bureau supports this legislation.

Special Election: T-SPLOST

- On the ballot: T-SPLOST

- “Shall a special one percent sales and use tax be imposed in the special district consisting of Oglethorpe County for a period of time of five (5) years and for the raising of an estimated net amount of $5,000,000 for transportation purposes?"

- What it’s asking: Should a 1% sales tax be imposed in Oglethorpe County for five years to raise money for improving transportation?

A vote “Yes” means: You support the 1% sales tax for improving transportation. T-SPLOST funds can be used for projects like resurfacing roads or improving drainage on roads. Funds cannot be used for paying government employees or other general expenses.